The policy—part of a broader “reciprocal trade” strategy—adds a universal 10% tariff on all imports, with elevated rates of 20% on EU goods, 32% on Taiwanese goods, and up to 54% on Chinese imports.

As we covered in our in-depth analysis, “U.S. Import Tariffs Set to Shake Up Yacht Market: Who Wins and Who Loses,” the implications are widespread—particularly for foreign-built superyachts. Buyers are already feeling the ripple effects, with higher prices, delivery delays, and questions around how to structure new purchases.

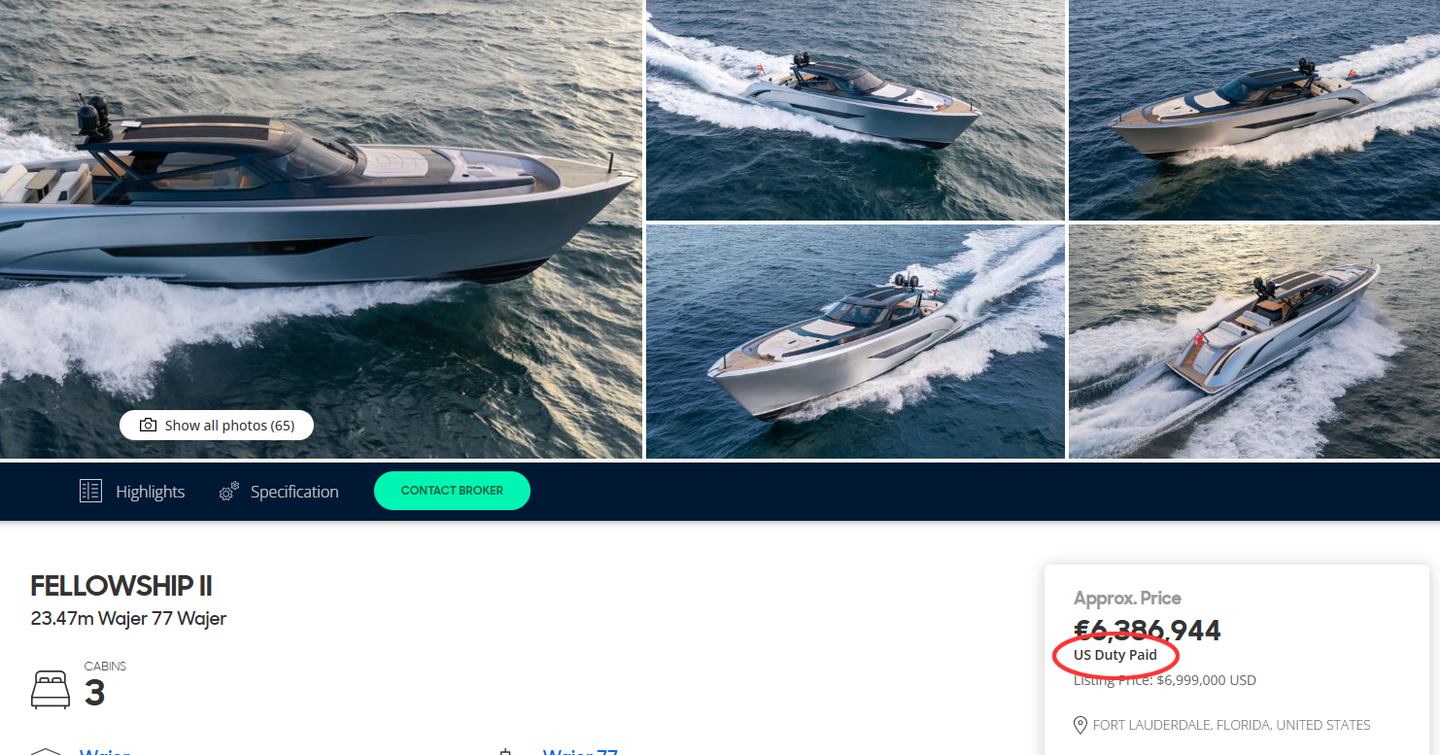

But there’s one clear strategy American buyers can lean into right now: buying a yacht that’s already been imported and is marked “U.S. Duty Paid.”

What Does “Duty Paid” Really Mean?

When a yacht has already cleared U.S. Customs and the import duty has been paid (by a dealer, importer, or previous owner), it’s officially part of U.S. domestic goods. That means:

- No additional tariffs apply—regardless of where the yacht was built.

- The vessel can be used or chartered in U.S. waters without restriction.

- The buyer avoids all logistics, legal filings, and customs procedures tied to direct importation.

Whether it's a sleek Italian flybridge or a rugged Taiwanese explorer yacht, if it’s duty paid, it’s ready to go—tariff-free.

Real Savings: Avoiding Tariffs Up to 54%

Here’s a practical example: A new Pearl 72 for sale, built in China, might face a 54% tariff if purchased directly from the shipyard or as an inbound new delivery. That could add over $2 million to a $4 million yacht.

However, if a U.S. dealer imported the same model six months ago and it's already listed in Florida with duty paid, the buyer pays no additional import tax. That’s an enormous savings—and with immediate availability, too.

What to Look for When Shopping

Here’s how U.S. buyers can shop smart in this new trade environment:

1. Search for Listings Labeled “U.S. Duty Paid”

- This indicates all customs charges have been settled.

- Always request a copy of the U.S. Customs Entry Summary Form 7501 to verify.

2. Buy from Dealer-Imported Inventory

- Many brands pre-import yachts into the U.S. for display or inventory purposes.

- These include brand-new vessels or demo models, already tariff-cleared.

3. Target Lightly Used Brokerage Yachts

- Yachts 1–3 years old that were originally sold in the U.S. are a sweet spot.

- They combine value and tariff immunity.

4. Be Wary of Foreign-Flagged Yachts in U.S. Waters

- If the yacht has not been formally imported, the buyer could still be liable for the full tariff on closing.

Why This Strategy Works

U.S. import tariffs are triggered only at the point of entry into the country. Once the yacht has cleared customs and duties are paid, it becomes a fully domestic asset. Reselling it incurs no further tariffs, making these boats especially attractive in today’s policy climate.

Final Tip: Work with a Broker Who Knows the Ropes

Marine customs regulations are complex, and errors can be costly. Partner with a yacht broker who understands duty status, can verify documentation, and guide you toward the best U.S.-based opportunities.

The Bottom Line

For U.S. yacht buyers hoping to avoid punitive tariffs, the most straightforward solution is already in the market: find a high-quality, already-imported, duty-paid yacht—and enjoy the water without the paperwork.

Interested in buying a yacht? View all new and used yachts for sale, tracked in real-time by YachtBuyer MarketWatch. We scan the entire market to ensure access to all genuine listings, saving you time. Alternatively, looking to go bigger you can view all superyachts for sale.