At 58.5m (191ft) Superyacht Phi holds a unique place in the yachting world as the longest superyacht under 500 gross tonnage (GT), an engineering and design marvel that pushed boundaries in lightweight construction and efficiency.

Before her detention, Phi embarked on her maiden voyage from the Netherlands to the UK to showcase her groundbreaking design at the World Superyacht Awards. Her presence in the capital was intended to highlight her status as a trailblazer in yacht design, but instead, her visit became embroiled in international controversy when she was seized under UK sanctions targeting Russian-linked assets.

A Seizure Rooted in Sanctions Law

The yacht, valued at £38 million, was detained under The Russia (Sanctions) (EU Exit) Regulations 2019, a cornerstone of the UK’s response to the conflict in Ukraine. Then-Transport Secretary Grant Shapps used provisions allowing for the detention of assets connected to Russia, even if the owner is not directly sanctioned.

The legal basis for the seizure included:

- Section 57C(1)(b): Permitting detention for any connection to Russia, regardless of its nature.

- Section 57D(1)(a): Empowering the Secretary of State to enforce such decisions.

Naumenko, who has no formal ties to Russian President Vladimir Putin or his regime, has contested the detention as unlawful. Despite not appearing on sanctions lists in the UK, EU, or the United States, the UK government argued that Naumenko’s connections to Russia justified the seizure under the sanctions framework.

Legal Battle Through the Courts

In July 2023, the High Court upheld the detention, with Judge Sir Ross Cranston ruling that it was a proportionate measure in the public interest. Cranston acknowledged that the decision interfered with Naumenko’s property rights under the European Convention on Human Rights but deemed the interference justified.

The decision was challenged in January 2024, when Naumenko’s legal team argued in the Court of Appeals that the detention was disproportionate and influenced by public statements linking the owner to Putin. While the Court criticized Shapps’ statements as inaccurate, it ruled that these errors did not impact the legality of the detention. The Court of Appeals ultimately upheld the High Court’s decision, affirming the seizure's lawfulness.

Ongoing Costs and Implications

While Phi remains detained in London, Naumenko has covered the vessel’s substantial maintenance costs. Superyachts like Phi require continuous upkeep to prevent deterioration, with annual expenses running into the millions.

The detention has also raised questions about the broader financial and legal challenges of enforcing sanctions. Maintaining seized yachts like Amadea and Alfa Nero places significant burdens on governments, with taxpayers often footing the bill. A Financial Times report highlighted how similar cases have strained public resources, citing examples where yachts incurred millions in maintenance costs while ownership disputes dragged on.

A Critical Turning Point

The Supreme Court hearing marks a critical moment not only for Naumenko but for the enforcement of sanctions on high-value assets. Naumenko, reportedly facing a terminal illness, sees this as a last opportunity to regain control of Phi.

Whether the Supreme Court sides with Naumenko or upholds the UK government’s actions, the case could set a significant precedent for the future of sanctions enforcement in the yachting industry. With superyachts increasingly targeted as symbols of wealth and influence, the outcome of this case will resonate far beyond the London docks where Phi remains moored.

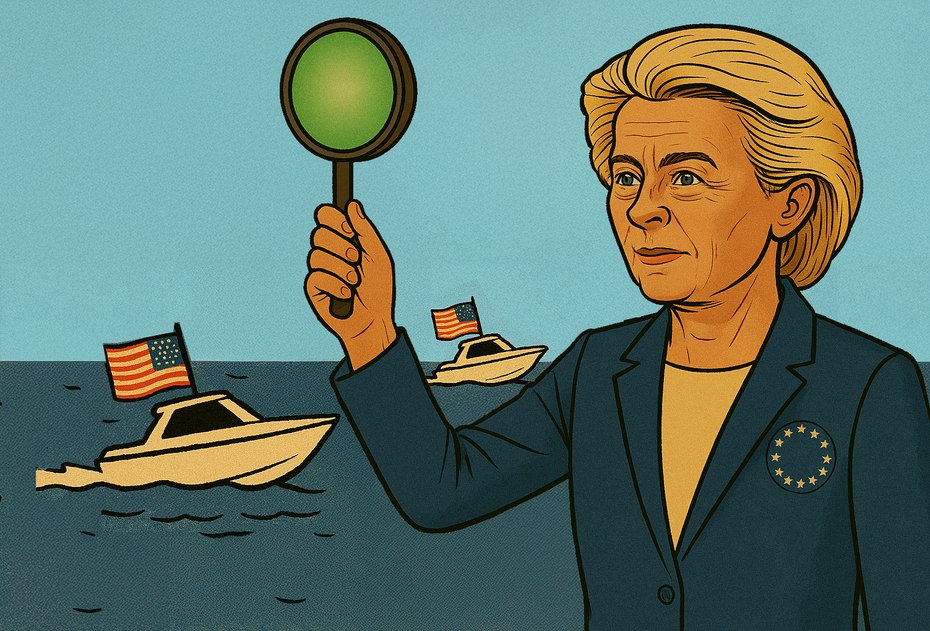

The Ripple Effect on Shipyards

Sanctions targeting Russian-linked assets have had far-reaching consequences for the superyacht industry, halting construction and delivery of high-value vessels and leaving European shipyards grappling with financial uncertainty. Shipyards in Germany and the Netherlands, many of which are renowned for crafting some of the world’s most luxurious yachts, have been particularly affected, with projects delayed or frozen due to blocked payments from sanctioned Russian clients.

Shipyards across Europe have reported an inability to receive crucial stage payments for yachts under construction for Russian owners. These funds, typically paid at key milestones during a yacht’s build, are essential to maintaining cash flow, paying workers, and procuring materials. Without these payments, projects have stalled, with partially completed yachts sitting idle and millions in revenue tied up in limbo.

German and Dutch builders, including major names like Nobiskrug, Feadship, Heesen and Damen, have felt the brunt of these disruptions. For example, Nobiskrug, known for its high-profile projects like Sailing Yacht A, has faced insolvency proceedings due in part to the financial strain caused by withheld payments from Russian clients. Similarly, Dutch shipyards have reported delays and significant economic fallout, with skilled jobs and local economies impacted.

Wider Industry Implications

The sanctions have not only affected shipyards but also rippled through the entire supply chain, from specialized subcontractors to equipment suppliers. Workers, many of whom rely on these shipyards for their livelihoods, face job uncertainty as the industry grapples with geopolitical challenges beyond its control.

The economic toll on shipyards contrasts sharply with the intended purpose of sanctions, which aimed to pressure Russian oligarchs by targeting their high-value assets. However, the measures have left the yachts themselves undelivered and the businesses building them financially compromised, raising questions about the overall effectiveness of these policies.

A Critical Moment for the Industry

As the superyacht industry navigates these turbulent waters, the long-term impact of sanctions remains unclear. While the measures have succeeded in freezing high-profile assets, they have also stalled production, disrupted global supply chains, and placed entire shipyards in financial jeopardy.

The situation underscores the need for a balanced approach to sanctions—one that considers not only their geopolitical objectives but also the unintended consequences for industries, businesses, and workers caught in the crossfire.