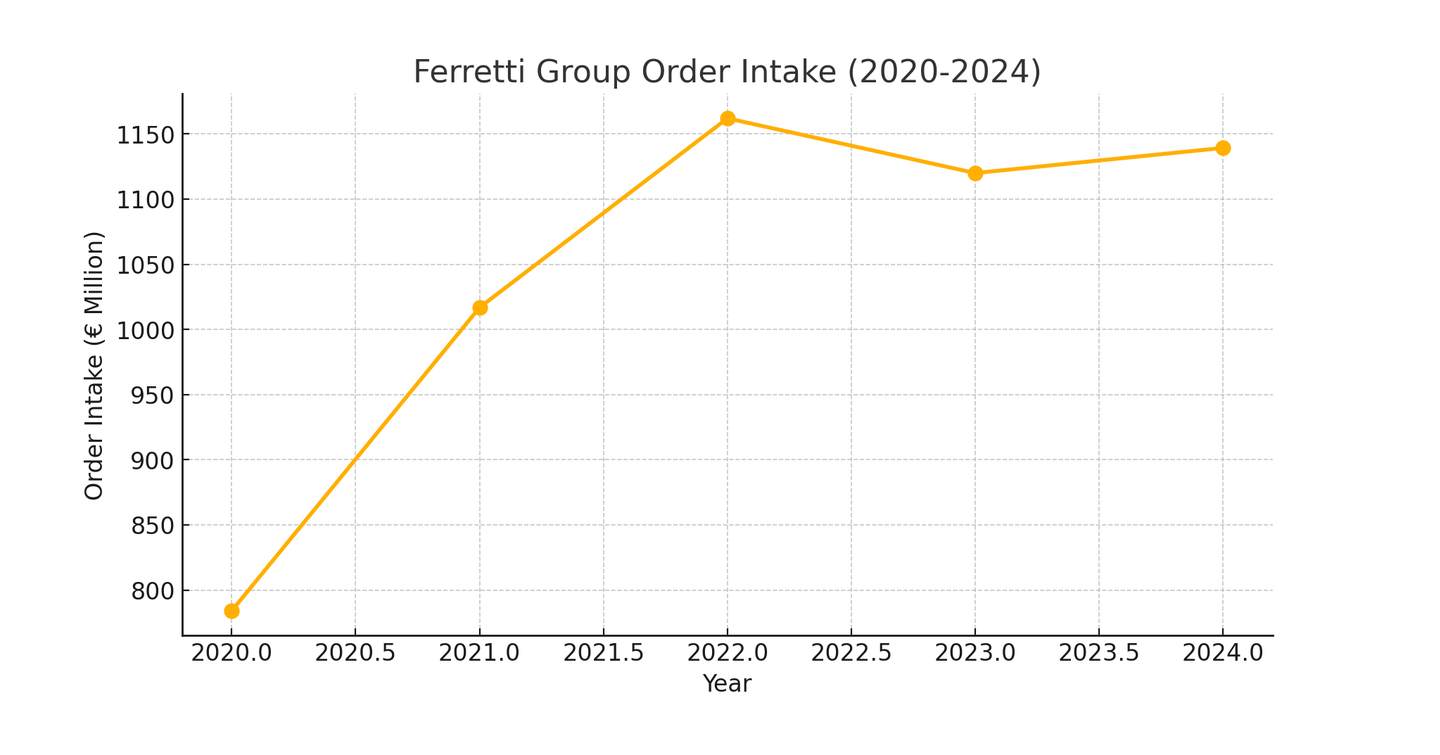

This growth comes despite a more modest rise in order intake, which reached €1,139.3 million, up just 1.7% from the previous year. The figures highlight the impact of the company’s backlog of previous orders, sustained demand for high-value superyachts, and improved operational efficiencies, allowing the company to scale production and enhance margins.

Ferretti Group operates a portfolio of prestigious brands catering to different segments of the luxury yacht market. These include Riva, known for its timeless elegance and craftsmanship; Pershing, specializing in high-performance luxury yachts; Custom Line, offering bespoke semi-custom yachts; CRN, focused on fully custom superyachts; Ferretti Yachts, recognized for its innovation in flybridge yachts; and Wally, pioneering cutting-edge design and advanced technology in sailing and motor yachts. This diversified brand portfolio enables Ferretti to appeal to a broad range of ultra-high-net-worth clients with varying preferences and yachting needs.

Key Financial Highlights:

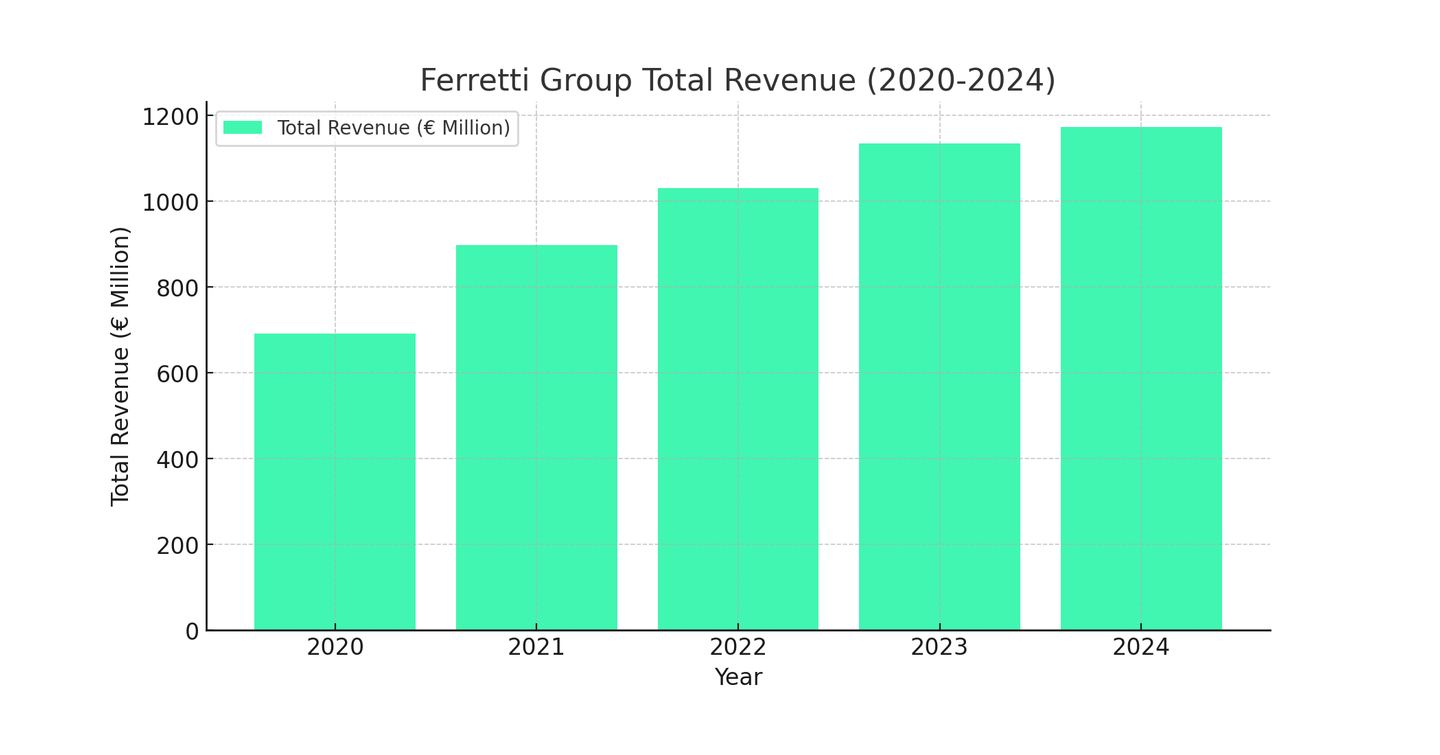

- Net Revenues from New Yachts: €1173.3 million (+5.6% from 2023)

- EBITDA: €190.0 million (+12.3%), with a 16.2% margin

- EBIT: €88.2 million (+5.6%)

- Net Cash Position: €124.6 million

- Order Backlog: €1.7 billion, with €736.9 million set for delivery in 2025

Revenue Growth Driven by Backlog and Premium Models

The order backlog has reached a record of €1.7 billion, marking an 11.6% increase compared to 2023 and an impressive 25.5% growth compared to the first nine months of 2024. This is our best result ever, driven not only by the exceptional performance of the last quarter but also by the continuous trust our customers place in our ability to innovate, ensure quality, and deliver maximum reliability.

Ferretti’s revenue trajectory over the past five years has been consistently upward, with figures rising from €692.2 million in 2020 to €1,173.3 million in 2024. The growth has been supported by an expanding production capacity and a strategic shift toward larger, higher-margin yachts.

Breaking down 2024’s revenue performance:

- Composite Yachts: €390.3 million (45.1% of new yacht revenue, +10.6% YoY)

- Made-to-Measure Yachts: €313.5 million (36.2%, -7.1% YoY)

- Super Yachts: €116.8 million (13.5%, +20.8% YoY)

- Other Businesses: €44.7 million (5.2%, -4.7% YoY)

The strong growth in superyacht revenue reflects Ferretti’s strategic positioning in the ultra-high-net-worth segment, where demand for bespoke, large-scale yachts remains strong despite economic uncertainties.

Order Intake Fluctuations and Long-Term Outlook

While revenues continued to rise, order intake has been less consistent. Between 2020 and 2022, order intake surged from €784 million to €1,162 million, reflecting a post-pandemic luxury boom. However, 2023 saw a 3.6% decline to €1,120 million, and 2024 registered only a modest 1.7% recovery.

This slight slowdown in new orders suggests a potential normalization after years of rapid growth. However, Ferretti’s €900 million backlog ensures strong future revenues, even if new orders slow in the short term. Moreover, a rising proportion of orders are for custom and superyacht models, which have longer production cycles but significantly higher per-unit revenues.

We close 2024 with great optimism and the satisfaction of having achieved extraordinary milestones. Our steady growth, year after year, has allowed us to achieve unprecedented results, both in terms of order backlog and margins, confirming the solidity of our strategy and the strength of our brands in the market.

Group’s Chief Executive Officer

What It Means for Ferretti Group’s Future

Ferretti’s financial performance underlines the dynamics of the luxury yacht industry, where revenue often lags behind order intake due to multi-year build times. The company’s ability to convert backlog into deliveries efficiently, while expanding its portfolio of premium yachts, has enabled consistent revenue growth even in years of softer order intake.

In 2024, Ferretti Group unveiled several innovative motor yacht models across its prestigious brands, reflecting the company's commitment to design excellence and technological advancement. Notable introductions include:

- Custom Line 50: The brand's first all-aluminum superyacht under 500 GT, featuring sleek exterior styling by Filippo Salvetti and bespoke interiors by ACPV ARCHITECTS Antonio Citterio Patricia Viel.

- Wallypower50: A high-speed model in the Wallypower range, also available in an outboard version—the wallypower50X—offering enhanced speed without compromising living comfort.

- Custom Line Navetta 38: A new addition to the Custom Line fleet, emphasizing spaciousness and comfort for extended cruising.

- Pershing GTX80: The latest in the GTX series, this yacht showcases on-board comfort and liveability, while delivering the excellent performance and sportiness inherent in Pershing's DNA.

These models highlight Ferretti Group's dedication to meeting diverse client preferences and solidifying its position at the forefront of the luxury yacht industry.

Looking ahead, Ferretti is well-positioned for further expansion, with strong fundamentals in place. However, continued monitoring of order intake trends will be crucial to assessing longer-term revenue sustainability. If demand for new orders remains subdued, the impact on revenues could become more evident in 2026-2027 as current backlogs are fulfilled.

Nonetheless, Ferretti’s brand strength, strategic pricing, and focus on high-value yachts ensure it remains a dominant force in the global luxury yacht industry.

Looking for your dream luxury yacht? Explore our complete collection of new & used Ferretti yachts for sale worldwide, tracked in real-time by YachtBuyer MarketWatch. We scan the entire market to ensure access to all genuine listings, saving you time. Alternatively, you can view all other new & used yachts for sale.