The company’s financial performance continues to strengthen, fueled by expansion in key global markets and strategic acquisitions.

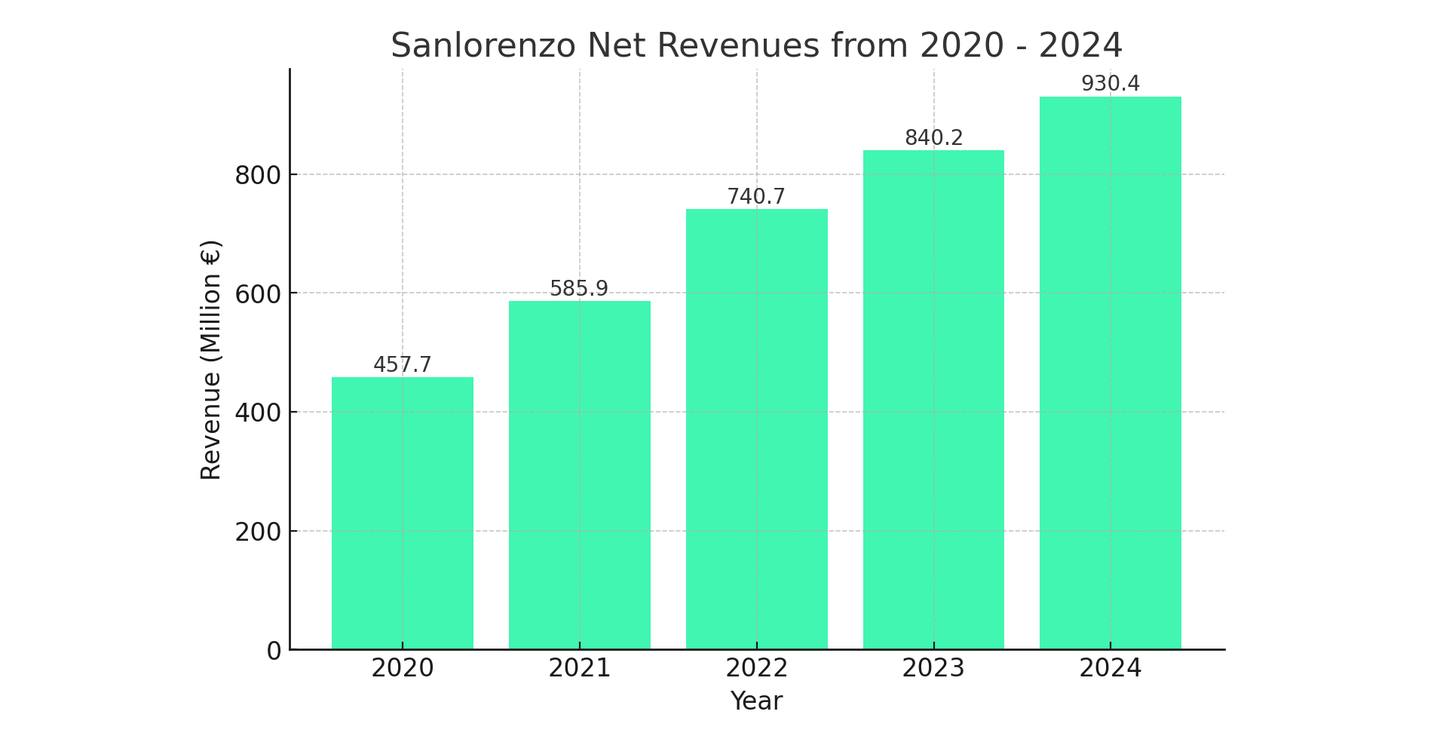

Sanlorenzo, known for its high-end "Haute Couture" approach to yacht building, recorded €930.4 million in net revenues from new yachts, up from €840.2 million in 2023. This marks the third consecutive year of double-digit revenue growth, underscoring the resilience of the ultra-luxury yachting sector.

Key Financial Highlights:

- Net Revenues from New Yachts: €930.4 million (+10.7% from 2023)

- EBITDA: €176.4 million (+12.0%), with a 19.0% margin

- EBIT: €139.3 million (+10.6%), with a 15.0% margin

- Net Cash Position: €29.1 million; excluding acquisitions, this stands at €112.8 million

- Order Backlog: €1.02 billion, with €623.1 million set for delivery in 2025

A Year of Expansion and Strategic Growth

Sanlorenzo’s Superyacht Division led the company's expansion with a 17.6% increase in revenue, reflecting the growing demand for large, custom-built yachts. Meanwhile, the Yacht Division and Bluegame Division experienced modest growth of 1.8% and 1.0%, respectively.

A major highlight of 2024 was the acquisition of a 60% stake in Nautor Swan, a renowned luxury sailing yacht builder, which contributed €38.3 million to Sanlorenzo’s revenue over the last five months of the year. The company also acquired 95% of Simpson Marine Group, a move aimed at strengthening its market presence in Asia.

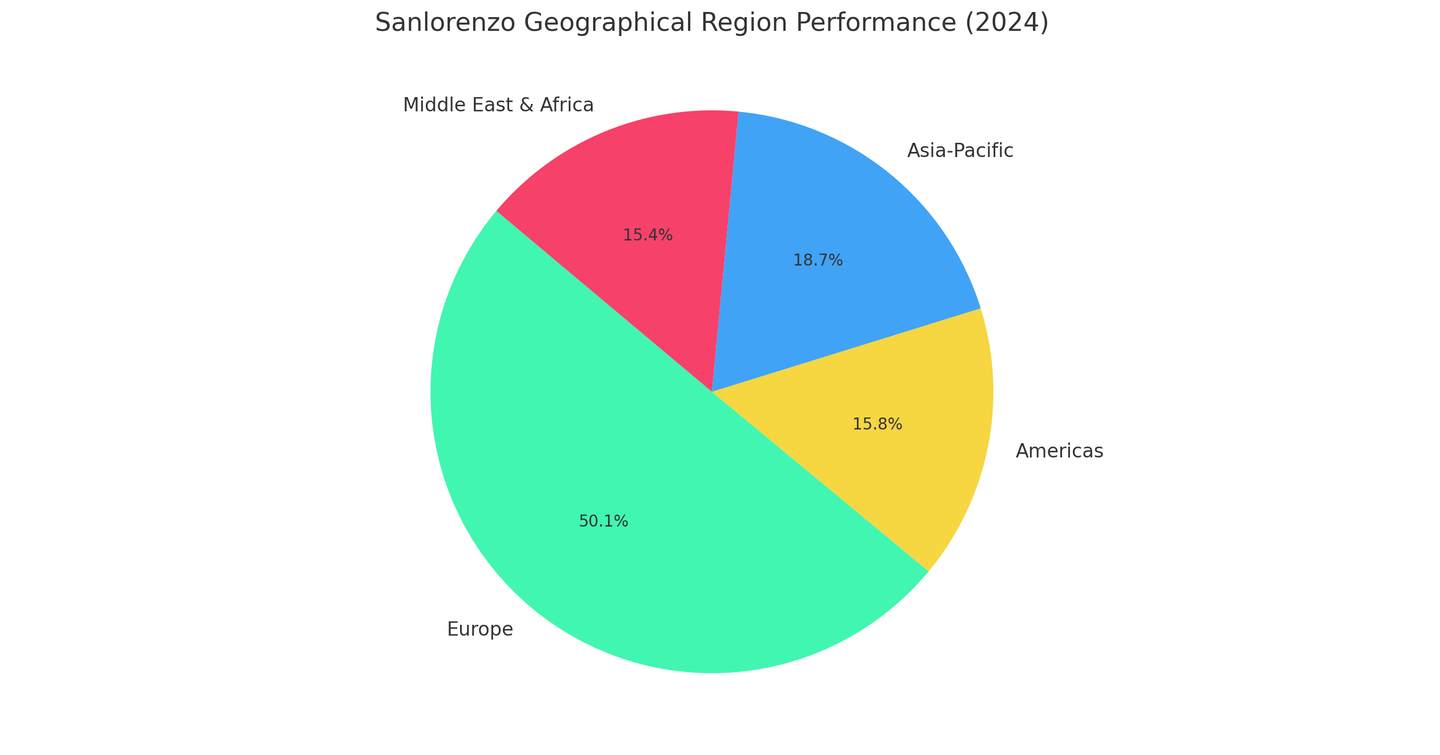

In terms of geographical performance, the Americas emerged as a significant growth driver, with a 58.4% increase in revenue, now representing 15.8% of total sales (up from 11.0% in 2023). The Middle East and Africa (MEA) region also saw an impressive 55.4% growth. However, Europe and Asia-Pacific (APAC) experienced slight declines of 0.9% and 2.3%, respectively, due to economic uncertainties.

Sanlorenzo’s Strategic Vision for 2025

Sanlorenzo has remained committed to innovation and industrial expansion, investing €49.3 million in new model development and manufacturing capacity. Including acquisitions, the company’s total investments reached €188.1 million for the year.

Despite challenges such as fluctuations in global economic conditions and shifting demand in certain regions, Sanlorenzo’s business model continues to thrive. Massimo Perotti, Executive Chairman of Sanlorenzo, expressed confidence in the company’s direction:

Our solid growth trajectory, confirmed by achieving results both in terms of revenues and margins, highlights the effectiveness of our 'Haute Couture' business model. Even in uncertain times, we have successfully expanded our global footprint and closed strategic acquisitions that strengthen our position in the luxury yachting market

Executive Chairman

Sanlorenzo

Thriving Order Book: Most Popular Models and Delivery Trends

Looking ahead to 2025, Sanlorenzo enters the year with a strong order book, covering nearly 88% of planned deliveries, reinforcing its reputation as one of the world’s premier yacht builders. The company’s strategic focus remains on sustainability, technological innovation, and enhancing its position in key high-growth markets.

According to YachtBuyer MarketWatch Data with well over 100 yachts now confirmed in Sanlorenzo’s order book, the brand is set for strong production over the coming years. The most popular models include the SX, SD, and 50 Steel series, with multiple units scheduled for delivery, reflecting strong demand for both explorer and superyacht models. The largest yacht on order remains the Sanlorenzo 76/230 (73.4m) set for delivery in 2028, followed closely by several Sanlorenzo 73 Steel models extending across 2025, 2026, and 2028.

Delivery Timeframe Breakdown

- 2025 is the busiest year, with over 40% of the order book scheduled for delivery, underscoring Sanlorenzo’s near-term production strength. The 44 Alloy, SX88, and SD series lead the volume, with a strong focus on 40m-50m yachts, reflecting market demand for mid-sized luxury yachts.

- 2026 accounts for approximately 25% of total deliveries, with standout models including the 73m motor yacht Virtuosity, the largest yacht in this batch, and multiple 57 Steel yachts, reinforcing demand for superyachts in the 50m+ segment.

- 2027 and 2028 represent 30% of the order book, ensuring long-term sustainability and steady production flow. This period includes two yachts over 70m, while models like the 50X-Space, 57 Steel, and SX120 will feature prominently, emphasizing Sanlorenzo’s ongoing commitment to innovation in both luxury and explorer yachting.

Key Insights on Popular Models

- SX Series (SX76, SX88, SX100, SX112, SX120): This line dominates, reflecting the market’s preference for crossover yachts that blend luxury and practicality.

- SD Series (SD90, SD96, SD118, SD132): The semi-displacement SD range is thriving, catering to owners seeking long-range cruising capabilities with timeless design.

- 50 Steel, 52 Steel, and 57 Steel: These steel-hulled yachts form a significant part of the portfolio, appealing to clients interested in larger, ocean-going vessels.

- Explorer Yachts (500EXP, 50X-Space, 42 Espace): The explorer category continues to grow, reflecting the industry trend toward adventure yachting.

Looking for your dream luxury yacht? Explore our complete collection of new & used Sanlorenzo yachts for sale worldwide, tracked in real-time by YachtBuyer MarketWatch. We scan the entire market to ensure access to all genuine listings, saving you time. Alternatively, you can view all other yachts for sale.