The company’s Board of Directors recently convened to review and approve financial results for the period, with strong revenue growth driven by flagship divisions and ongoing investments in capacity expansion. With a substantial order backlog and positive momentum internationally, Sanlorenzo is well-positioned to strengthen its leadership in the luxury yachting sector.

Financial Performance Overview

Net Revenues from New Yachts: The company achieved €669 million in net revenues from new-build yachts during the first nine months of 2024, marking a 6.9% increase from €626 million in the same period of 2023. The third quarter alone contributed €253.9 million to this total.

Divisional Contributions:

- Yacht Division: Reported €384.4 million in net revenues, bolstered by the introduction of models such as the SP92 and SL86-Asymmetric at the 2024 Cannes Yachting Festival, along with pre-launch sales of the SD132 model.

- Superyacht Division: Recorded €198 million in net revenues, a 15.4% increase from the previous year, driven by the continued success of the Steel line.

- Bluegame Division: Achieved €69 million in net revenues, reflecting a 3.1% year-over-year growth.

- Swan Division: Contributed €17.6 million in net revenues since its consolidation on August 1, 2024.

Geographical Performance

The Americas experienced a significant growth of 38.8%, the Middle East and Africa (MEA) region saw robust development at 80%, and the Asia-Pacific (APAC) region had solid performance, increasing by 16.6%, though Mainland China was an exception. However, Europe experienced a 9% decline.

Earnings

- EBITDA: Reached €123.6 million, an 8.6% increase from €113.8 million in the first nine months of 2023, with a margin of 18.5% on net revenues from new yachts.

- EBIT: Amounted to €97.5 million, a 6.8% rise from €91.3 million in the same period of 2023, with a margin of 14.6%.

- Pre-Tax Profit: Totaled €101 million, a 7.3% increase from €94.1 million in the previous year.

- Group Net Profit: Rose to €72.9 million, up by 9% from €66.9 million during the same period last year, with a margin of 10.9% on net revenues from new yachts.

Balance Sheet and Financial Position

- Net Working Capital: Stood at negative €4.2 million as of September 30, 2024, improving from negative €34.9 million at the end of 2023 and negative €59.5 million as of September 30, 2023.

- Inventories: Increased to €153.6 million, reflecting a rise of €68.2 million since December 31, 2023, primarily due to higher levels of raw materials and work-in-progress products to meet demand.

- Investments: Organic net investments during 2024 amounted to €27.8 million, with 88% directed towards expanding industrial capacity and developing new models. Including acquisitions, total investments rose to €162.1 million.

- Net Cash Position: Stood at €27.2 million, down from €140.5 million on December 31, 2023, due to dividend payments, organic investments, and acquisitions, including the Nautor Swan Group and Simpson Marine Group.

In the first nine months of the year, the results once again confirm the solidity of our group, which continues to grow even in challenging environments, thanks to a balanced and carefully planned strategy. With a net backlog exceeding one billion euros, 90% of which is sold to final clients with whom we have established close and authentic relationships, we are immune to the stocking-destocking dynamics of distribution networks typical of players exposed to smaller-sized and/or lower-positioned product segments.

Chairman and CEO

Sanlorenzo

Backlog and Order Intake

Backlog: As of September 30, 2024, the backlog was €1.72 billion, including €128.7 million from the Swan Division, up from €1.67 billion a year earlier.

Net Backlog: Reached €1.05 billion, providing strong visibility on future revenues, with €875.9 million allocated to the current year and €844 million for subsequent years.

Order Intake: Totaled €582.7 million for the first nine months of 2024, reflecting a normalization compared to €604.5 million in the same period of 2023.

Popular New Production Models

Sanlorenzo's financial success in 2024 has been significantly bolstered by the strong market performance of several new yacht models:

SP92: Introduced at the 2024 Cannes Yachting Festival, the SP92 is the second model in Sanlorenzo's Smart Performance line. Measuring 27.9 meters, it features a 45-square-meter customizable beach area and can reach speeds up to 40 knots. The SP92 has been well-received for its blend of performance and luxury.

SL86A: Also debuting at the Cannes Yachting Festival, the SL86A represents an evolution in Sanlorenzo's Asymmetric line. This 26.6-meter yacht offers increased interior volume and enhanced sea views through floor-to-ceiling windows by moving the port side deck up a level. The redesigned stern houses both a Williams tender and jetski. The SL86A has been praised for its innovative design and spacious layout.

SD132: Pre-launch sales of the new SD132 model have contributed to Sanlorenzo's revenue growth. This model is part of the SD line, known for blending classic design with modern technology, offering spacious interiors and long-range cruising capabilities.

Large Superyacht Sales

Sanlorenzo’s recent financial success can be attributed not only to strong sales across its model lines but also to significant ongoing orders for large superyachts currently under construction at the yard. Among the largest is the 76 Steel/230, a 73.4-meter superyacht scheduled for completion in 2028. Another impressive project, the 73 Steel/220, also 73 meters, is expected to be delivered in 2028, with a similar model, Virtuosity, set to launch in 2026.

The demand for Sanlorenzo’s large superyachts is evident with multiple high-profile models on order. The 72-meter 73 Steel/200 is slated for 2025, while the 64 Steel/190, a 64-meter superyacht, is anticipated in 2026 and is currently available for sale. Further reinforcing Sanlorenzo's position in the superyacht market, other sizable projects include the 61.2-meter 61/154, set for 2024, and the 60-meter 1150EXP, due in 2027.

Sanlorenzo's 57 Steel series also remains popular, with units scheduled for delivery between 2024 and 2026, all accommodating 12 guests. This lineup of large superyachts reflects a sustained demand and strategic commitment to producing high-end, custom yachts, positioning Sanlorenzo at the forefront of the luxury yachting market.

2024 Guidance

Sanlorenzo has reaffirmed its 2024 guidance for net revenues from new yachts, EBITDA, EBIT, group net profit, and investments, both organically and on a consolidated basis, including contributions from recent acquisitions. The company has also revised its net financial position guidance for December 31, 2024, to a range of €110 to €120 million, down from the previously projected €160 to €170 million, reflecting improved financial dynamics.

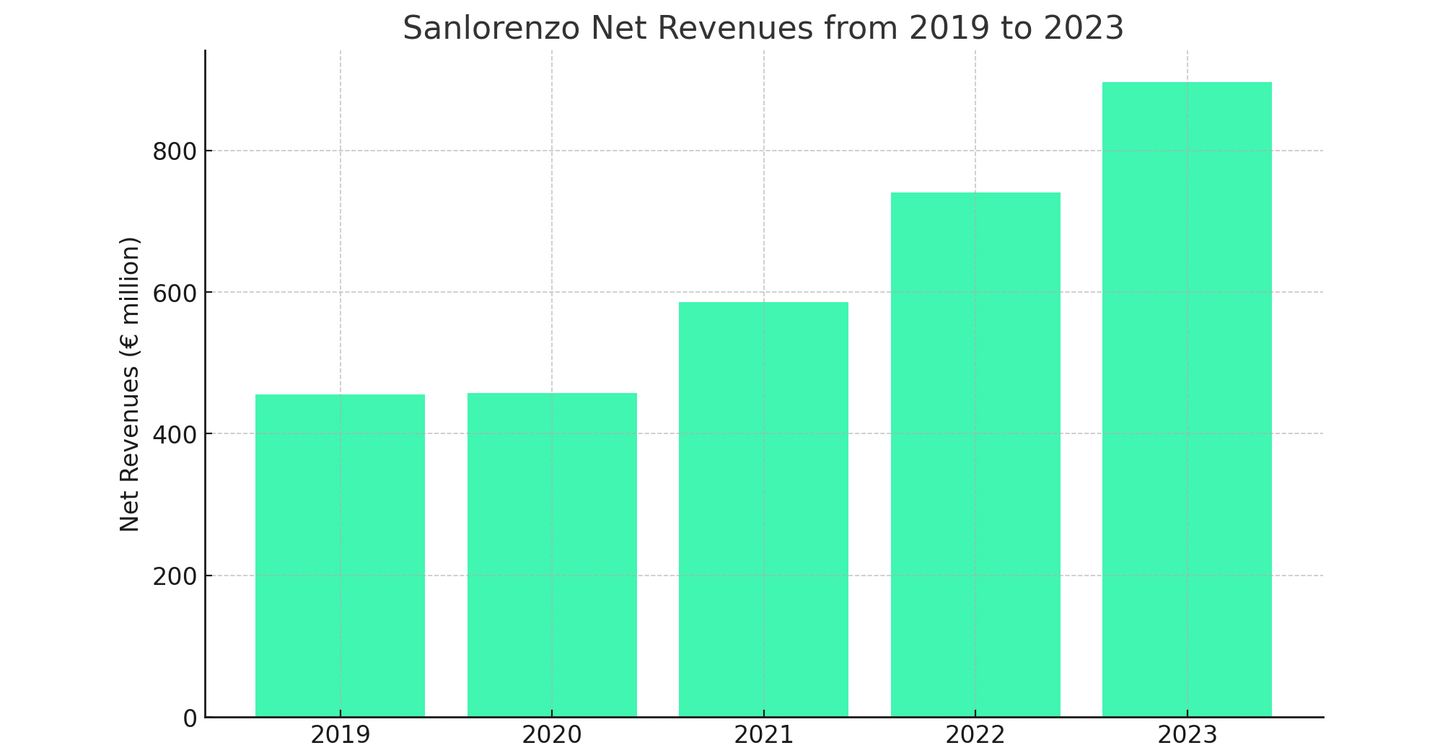

Historical Financial Performance

In the fiscal year ending December 31, 2023, Sanlorenzo reported net revenues from new yachts of €840.2 million, an 18.7% increase from the previous year. The group net profit for 2023 was €92.8 million, a 25.2% increase from 2022. The net cash position as of December 31, 2023, was €140.5 million.

These results highlight Sanlorenzo's consistent growth trajectory and its strategic initiatives to expand its product portfolio and market presence.

Following the announcement of its financial results shares in Sanlorenzo S.p.A. (BIT: SL) experienced a positive movement. On November 1, 2024, the stock closed at €34.70, reflecting a 0.29% increase from the previous close.

This uptick suggests that investors responded favorably to the company's reported 9% increase in group net profit and other financial metrics.

Looking for your dream luxury yacht? Explore our complete collection of Sanlorenzo yachts for sale worldwide, tracked in real-time by YachtBuyer MarketWatch. We scan the entire market to ensure access to all genuine listings, saving you time. Alternatively, you can view all other yachts for sale.